Florida Man finally makes the smartest move of his life — getting life insurance.

Jokes aside, life in Florida is unpredictable. Hurricanes, accidents, and health surprises happen. The smartest move you can make is protecting your loved ones with affordable life insurance.

Protect your Family's Financial Future

Affordable Monthly Premiums

Fast Approval Process

FBack by Trusted Providers

Here’s Why Florida Families Trust Us

Fast Approval:

Quotes in minutes, coverage in days.

Affordable Plans:

Options for Every Budget

Protect your Family's future:

Peace Of Mind that Last.

Local Experts:

we Live in florida, too - we Get It

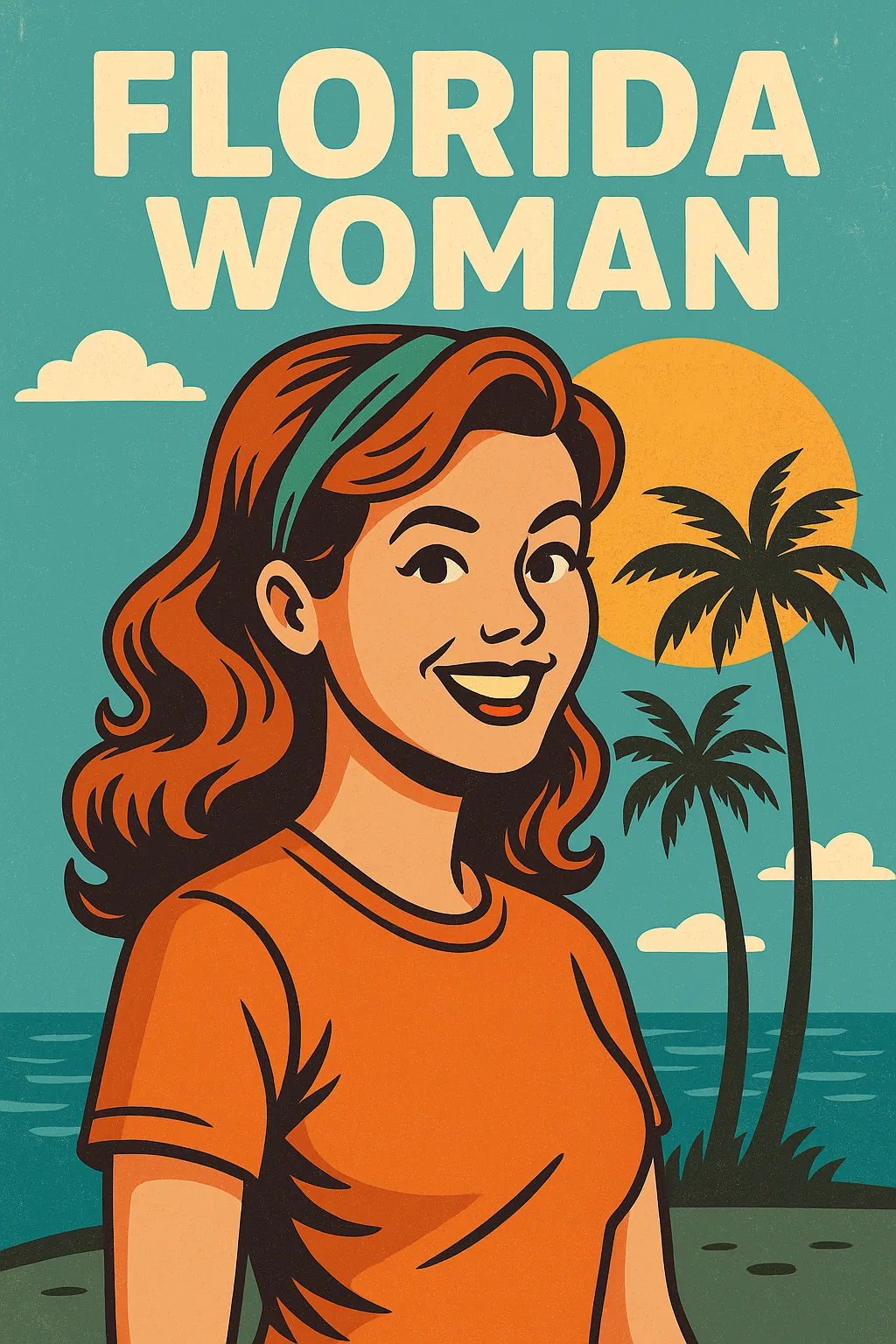

Florida WoMan Power:

The Smartest Move You’ll Ever Make

Florida Woman doesn’t wait around; she takes action to protect her family’s future.

Whether you’re a Florida Man or WoMan, securing life insurance today is the smartest move you can make.

Get Your Free Quote in Minutes

Fill out the form below, and one of our licensed Florida agents will contact you. Need help? Call us directly at (407) 698-1789

You’re Not Alone

Florida Families Just Like Yours Trust Us

Join the hundreds of Florida families who’ve made the smart move. No crazy headlines here — just peace of mind.

I never realized how important life insurance was until my close friend experienced a sudden loss. I immediately sought out Florida Man Coverage Inc, and the experience was nothing short of excellent. The advisors were knowledgeable and compassionate, helping me navigate the process with ease. Now, I feel confident that my family won't face financial hardships in the event of the unexpected. It’s more than just a policy—it’s a promise to those I love.

James R

Choosing life insurance with Florida Man Coverage Inc was one of the best decisions I've ever made. The peace of mind knowing that my family will be financially secure, no matter what happens, is invaluable. The team was incredibly patient and took the time to explain all my options, ensuring I found the perfect policy to meet my needs. I can now focus on living life to the fullest, knowing that my loved ones are protected.

Sarah M

Frequently Asked Questions

What is life insurance, and how does it work?

Life insurance is a contract between you and an insurance company, where you pay regular premiums, and in return, the company provides a lump-sum payment, known as a death benefit, to your beneficiaries upon your passing. This payment can be used to cover expenses such as funeral costs, mortgage payments, and other financial needs.

What types of life insurance policies are available?

There are primarily two types of life insurance: Term life insurance, which provides coverage for a specified period (e.g., 10, 20, or 30 years), and Whole life insurance, which offers lifelong coverage and includes a savings component that builds cash value over time.

How much life insurance coverage do I need?

The amount of life insurance you need depends on your financial obligations, such as mortgage payments, outstanding debts, future education costs, and your family's living expenses. A general rule of thumb is to have coverage that is 5-10 times your annual income, but this can vary based on individual circumstances.

Can I change my life insurance policy after purchasing it?

Yes, many life insurance policies offer flexibility. You may be able to adjust your coverage amount, convert a term policy to a whole life policy, or add riders for additional benefits. It's important to review your policy regularly and discuss any changes with your insurance advisor to ensure it continues to meet your needs.

Ready to Be the Smartest Florida Man (or Woman) Yet?

Questions? Call us now at (407) 698-1789.

Shop: 1440 SHARON ROSE TRACE, Deltona FL 32725

Call 6467122871

Email:

Site: floridamancoverage.com